How To Sell Your Fixer Upper

Have you been thinking about selling your fixer upper? Perhaps you’ve been hesitant to get started – selling a home can be a daunting task, let alone one that needs obvious work. Perhaps you’ve got an outdated kitchen, a closed-off floor plan or a bathroom that hasn’t been updated since 1932.

Have you been thinking about selling your fixer upper? Perhaps you’ve been hesitant to get started – selling a home can be a daunting task, let alone one that needs obvious work. Perhaps you’ve got an outdated kitchen, a closed-off floor plan or a bathroom that hasn’t been updated since 1932.

But don’t worry! While a fixer upper isn’t right for every potential buyer, there are people out there who may be looking for exactly what you have to offer. Here’s what you should keep in mind to make the most of your fixer upper listing.

Emphasize your home’s qualities

Maybe your home needs new floors or a landscape overhaul – but that doesn’t mean it doesn’t have its own special perks or charm. Take a good look around your home and see what qualities it does have that can help sell it. Is it situated on a large lot with beautiful, old trees? Is the woodwork original? Maybe it’s in a desirable location with a good school system. Emphasize those qualities when marketing your property.

Choose the right price

Potential homeowners interested in a fixer upper aren’t looking to pay top dollar for your house – they’re hunting for a bargain. If the price is too high, you’ll likely scare off some possible buyers. Check the comparables in your neighborhood and price your home lower. Draw attention to your bargain price in marketing materials to attract those who are looking to trade in their carpentry skills for a price break.

Fix it up

Obviously you won’t be making extensive repairs to your fixer upper before you sell it, but it won’t hurt to give it a little makeover. Make sure it’s clean, add a new coat of paint, conduct priority repairs like plumbing or roof repair, trim and clean the yard and stage it so prospective buyers can imagine what it might be like to live there once it’s fixed up. If the property requires a new commercial roof construction, you should consider hiring professional roofers who can provide professional commercial roofing installation services.

Be honest

It’s important that you’re upfront about the condition of your fixer upper from the start. Make it clear in marketing materials that the house will need some work – you’ll save yourself the headache of having to deal with disappointed prospects. During the closing process you’ll need a home inspection, which will highlight whatever flaws exist, so be sure to be open about them from the beginning.

Work with the right agent

Not all real estate agents have experience selling fixer uppers. Call several agents and ask them about their history selling homes that need repairs. Contact those who normally sell homes in the price range you’re looking for; they’ll have the knowledge you need about the current market and how to properly price your home so that it sells quickly and doesn’t sit languishing on the market for months. They’ll also be able to offer advice about any repairs that may be essential before you sell and how to best market your property.

All in all, selling a fixer upper doesn’t need to be an overly difficult process. By knowing your home’s selling points and working with the right agent, in the end you can have a sale you feel good about.

Does choosing the perfect paint color for your home feel a little bit like finding Bigfoot – mythical and elusive? Do you stare at the racks and racks of paint chips at the hardware store and break out in The answer might be in a professional from

Does choosing the perfect paint color for your home feel a little bit like finding Bigfoot – mythical and elusive? Do you stare at the racks and racks of paint chips at the hardware store and break out in The answer might be in a professional from  Your house isn’t just a financial investment or the place where you keep your stuff – it’s where you live your life. And moving into a new house can feel a little

Your house isn’t just a financial investment or the place where you keep your stuff – it’s where you live your life. And moving into a new house can feel a little

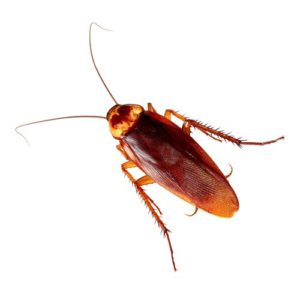

Spiders and roaches and flies, oh my! If bugs give you the heebie jeebies, you definitely don’t want them in your home. Not only can they be unsanitary, some pests can actually cause real damage. And then there are the insects that sting and bite, like wasps or scorpions. Obviously they’re not welcome, and contacting a

Spiders and roaches and flies, oh my! If bugs give you the heebie jeebies, you definitely don’t want them in your home. Not only can they be unsanitary, some pests can actually cause real damage. And then there are the insects that sting and bite, like wasps or scorpions. Obviously they’re not welcome, and contacting a  A home inspection conducted by a professional is a typical part of the process of buying a home. It’s an opportunity to evaluate the property and understand any issues that may need to be addressed. Sometimes the inspection uncovers problems that can be repaired. But how do you know which problems are minor issues and which ones are deal breakers?

A home inspection conducted by a professional is a typical part of the process of buying a home. It’s an opportunity to evaluate the property and understand any issues that may need to be addressed. Sometimes the inspection uncovers problems that can be repaired. But how do you know which problems are minor issues and which ones are deal breakers?

Catch Our Feed

Catch Our Feed Subscribe via Email

Subscribe via Email Follow Our Tweets

Follow Our Tweets Friend Us On Facebook

Friend Us On Facebook Watch Us On Youtube

Watch Us On Youtube